Overview

Overview

Pre-pandemic, the notion of buying a used car online would have seemed as alien to us as the pandemic itself.

Fast-forward a few years, and it's a standard model, but building that user trust created some interesting product design challenges.

First, how might we make financing transparent in an industry renowned for the opposite?

Pre-pandemic, the notion of buying a used car online would have seemed as alien to us as the pandemic itself.

Fast-forward a few years, and it's a standard model, but building that user trust created some interesting product design challenges.

First, how might we make financing transparent in an industry renowned for the opposite?

Role: Lead Product Designer

Role: Lead Product Designer

Role: Lead Product Designer

Responsibility: Sole design responsibility. Project collaboration with Engineering & PM

Responsibility: Sole design responsibility. Project collaboration with Engineering & PM

Responsibility: Sole design responsibility. Project collaboration with Engineering & PM

Cake Mix and car finance

Financing a car can be complicated, with endless acronyms and the smallest of small print. As a team, we wanted to streamline the process and make finance more accessible for our customers.

But it turns out it isn't simple to make things simple.

When we tested our new, simplified design with users, we found that they performed worse than the complex originals, thanks to those pesky internal cognitive biases.

Our attempt to shift the complexities away from the user and into the backend of the process resulted in an oversimplification that undermined our customers' trust, as they no longer felt like active participants.

If the legend is to be believed, the original cake mix manufacturers also faced the same problem. Users of the mix found the addition of dried eggs to be 'lazy,' which reduced their trust in the product. In response, the manufacturers changed the recipe to require a fresh egg, bringing back more active participation and ensuring its success.

Who knew car finance and cake had so much in common? Well, Larry Tesler, apparently.

Financing a car can be complicated, with endless acronyms and the smallest of small print. As a team, we wanted to streamline the process and make finance more accessible for our customers.

But it turns out it isn't simple to make things simple.

When we tested our new, simplified design with users, we found that they performed worse than the complex originals, thanks to those pesky internal cognitive biases.

Our attempt to shift the complexities away from the user and into the backend of the process resulted in an oversimplification that undermined our customers' trust, as they no longer felt like active participants.

If the legend is to be believed, the original cake mix manufacturers also faced the same problem. Users of the mix found the addition of dried eggs to be 'lazy,' which reduced their trust in the product. In response, the manufacturers changed the recipe to require a fresh egg, bringing back more active participation and ensuring its success.

Who knew car finance and cake had so much in common? Well, Larry Tesler, apparently.

Qualitative & Quantitive

To support the quantitative data from our A/B test showing a preference for more complex designs, we conducted a moderated test with 25 participants to explore our hypothesis that design simplification reduced trust and, therefore, engagement.

To support the quantitative data from our A/B test showing a preference for more complex designs, we conducted a moderated test with 25 participants to explore our hypothesis that design simplification reduced trust and, therefore, engagement.

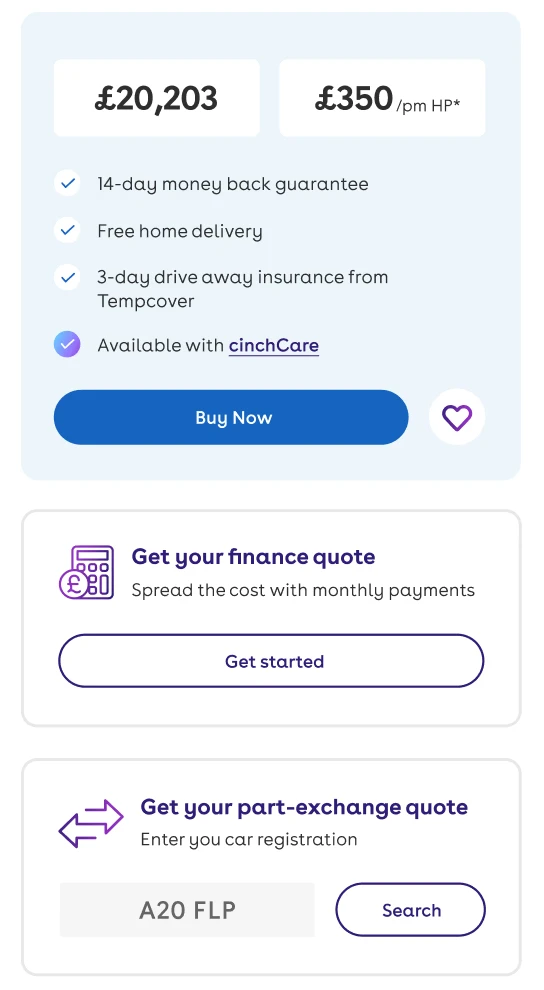

A number of users stated that they believed the representative price was the final price (£350) and felt misled when this changed in checkout.

“It seems like that price is just there to lure me in!”

A number of users stated that they believed the representative price was the final price (£350) and felt misled when this changed in checkout.

“It seems like that price is just there to lure me in!”

A number of users stated that they believed the representative price was the final price (£350) and felt misled when this changed in checkout.

“It seems like that price is just there to lure me in!”

Around 40% of users understood the figures were representative but were either unsure how to find a personalised price or hesitated about doing so before proceeding to checkout.

“If I use the calculator, will it affect my credit rating?”

Around 40% of users understood the figures were representative but were either unsure how to find a personalised price or hesitated about doing so before proceeding to checkout.

“If I use the calculator, will it affect my credit rating?”

Around 40% of users understood the figures were representative but were either unsure how to find a personalised price or hesitated about doing so before proceeding to checkout.

“If I use the calculator, will it affect my credit rating?”

The topic of “hidden fees at checkout” came up regularly in testing suggesting this is a common mental model for users.

“I know how these things work, it’ll be another £300 at the end!”

The topic of “hidden fees at checkout” came up regularly in testing suggesting this is a common mental model for users.

“I know how these things work, it’ll be another £300 at the end!”

The topic of “hidden fees at checkout” came up regularly in testing suggesting this is a common mental model for users.

“I know how these things work, it’ll be another £300 at the end!”

Insight led Interfaces

Insight Led UI

With qualitative and quantitative data supporting our hypothesis, I used these insights to underpin the redesign.

One of the most significant changes as a result was replacing "Go to Checkout" with "Get A Personalised Quote" for pay monthly journeys. Although this added friction to the process, it was essential for keeping the customer active and informed during their purchasing journey.

With qualitative and quantitative data supporting our hypothesis, I used these insights to underpin the redesign.

One of the most significant changes as a result was replacing "Go to Checkout" with "Get A Personalised Quote" for pay monthly journeys. Although this added friction to the process, it was essential for keeping the customer active and informed during their purchasing journey.

Grouping & Styling

A toggle view was added to simplify purchase comparisons and improve accessibility by reducing the number of numerical values in view at one time.

General USPs have been separated from finance-related content, allowing the user to contextualise the information more effectively and reducing cognitive load.

Grouping & Styling

A toggle view was added to simplify purchase comparisons and improve accessibility by reducing the number of numerical values in view at one time.

General USPs have been separated from finance-related content, allowing the user to contextualise the information more effectively and reducing cognitive load.

Grouping & Styling

A toggle view was added to simplify purchase comparisons and improve accessibility by reducing the number of numerical values in view at one time.

General USPs have been separated from finance-related content, allowing the user to contextualise the information more effectively and reducing cognitive load.

Content Design & Clarity

CTA copy has been revised to clarify affordances, particularly for screen reader users.

CTA copy has been modified to directly reference personalisation, which users highlighted as missing or misunderstood.

A representative breakdown has been clearly linked for those users wanting this level of detail. This has been designed with white space and hierarchy to aid accessibility.

Content Design & Clarity

CTA copy has been revised to clarify affordances, particularly for screen reader users.

CTA copy has been modified to directly reference personalisation, which users highlighted as missing or misunderstood.

A representative breakdown has been clearly linked for those users wanting this level of detail. This has been designed with white space and hierarchy to aid accessibility.

Content Design & Clarity

CTA copy has been revised to clarify affordances, particularly for screen reader users.

CTA copy has been modified to directly reference personalisation, which users highlighted as missing or misunderstood.

A representative breakdown has been clearly linked for those users wanting this level of detail. This has been designed with white space and hierarchy to aid accessibility.

Personalisation

Users are now able to switch between personalised HP and PCP financing results, facilitating comparison and understanding of the options available.

Personalised quotes persist and replace the representative example after the initial calculator interaction; this limits confusion and makes final costs more transparent across the purchasing journey.

Personalisation

Users are now able to switch between personalised HP and PCP financing results, facilitating comparison and understanding of the options available.

Personalised quotes persist and replace the representative example after the initial calculator interaction; this limits confusion and makes final costs more transparent across the purchasing journey.

Personalisation

Users are now able to switch between personalised HP and PCP financing results, facilitating comparison and understanding of the options available.

Personalised quotes persist and replace the representative example after the initial calculator interaction; this limits confusion and makes final costs more transparent across the purchasing journey.

"An excellent experience from search to delivery.

An easy search function; great selection of cars; easy to see and understand finance and purchase options; and arranging delivery was timely and convenient."

"An excellent experience from search to delivery.

An easy search function; great selection of cars; easy to see and understand finance and purchase options; and arranging delivery was timely and convenient."

- Andrew Chamberlin (Trustpilot)

- Andrew Chamberlin (Trustpilot)

"An excellent experience from search to delivery.

An easy search function; great selection of cars; easy to see and understand finance and purchase options; and arranging delivery was timely and convenient."

- Andrew Chamberlin (Trustpilot)

"The online buying experience was quick and easy. Finance, all done online with the final agreement amount matched the original estimation...

often not the case with many sites trying to lure you in with lower monthly prices!"

- Karl Webster (Trustpilot)

"The online buying experience was quick and easy. Finance, all done online with the final agreement amount matched the original estimation...

often not the case with many sites trying to lure you in with lower monthly prices!"

- Karl Webster (Trustpilot)

"The online buying experience was quick and easy. Finance, all done online with the final agreement amount matched the original estimation...

often not the case with many sites trying to lure you in with lower monthly prices!"

- Karl Webster (Trustpilot)

Results

Conversions increased by a third

Contacts reduced by 80%

Conversions increased by a third

Subsequent testing saw a statistically significant preference for the redesign over the more complex originals in our A/B tests.

One implemented interaction with the finance calculator increased, and conversions via this path increased by 33%.

Customers expressed greater satisfaction with the redesigned journey, citing improved transparency in Trustpilot reviews.

The effect of changes such as this one culminated in conversions increasing by 130% during my time as UX Lead in the 'Search & Convert' Tribe.

Subsequent testing saw a statistically significant preference for the redesign over the more complex originals in our A/B tests.

One implemented interaction with the finance calculator increased, and conversions via this path increased by 33%.

Customers expressed greater satisfaction with the redesigned journey, citing improved transparency in Trustpilot reviews.

The effect of changes such as this one culminated in conversions increasing by 130% during my time as UX Lead in the 'Search & Convert' Tribe.

Subsequent testing saw a statistically significant preference for the redesign over the more complex originals in our A/B tests.

One implemented interaction with the finance calculator increased, and conversions via this path increased by 33%.

Customers expressed greater satisfaction with the redesigned journey, citing improved transparency in Trustpilot reviews.

The effect of changes such as this one culminated in conversions increasing by 130% during my time as UX Lead in the 'Search & Convert' Tribe.